Buy now, pay later (also known as BNPL) payment methods allow your customers to pay for orders over time using a series of payments. For example, a customer could pay for a $2,000 USD product in four installments of $500 USD. You, the merchant, would still receive the full amount immediately — minus fees of course.

How do BNPL methods work?

↑ Back to topBNPL services are used by a variety of businesses to increase conversion, increase average order value, and reach new customers. The BNPL providers underwrite customers, manage the installments, and collect payments — so you can focus on your own business.

Are BNPL methods a good fit for my business?

↑ Back to topBNPL payment methods may be a good fit for your business if:

- You sell high-value goods or services and want to increase conversion.

- You sell low-value goods or services and want to increase the average order value.

- You’re trying to reach customers who might not have access to credit cards.

- You want to sell to customers who may not be able to pay in full right away.

However, BNPL payment methods may not be a good fit for you if:

- You sell to businesses, as BNPL methods cannot be used for B2B transactions.

- You sell subscriptions, as BNPL methods cannot be used for subscription products.

Do customers pay more when using BNPL methods?

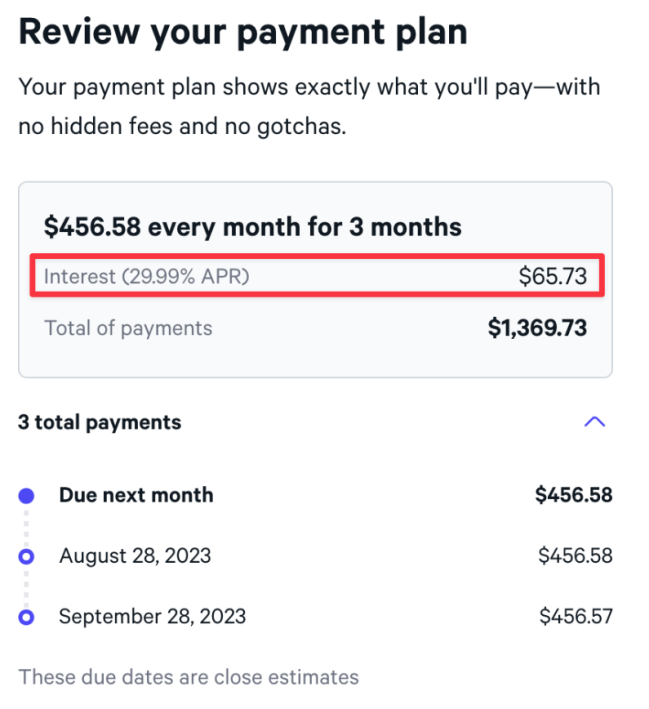

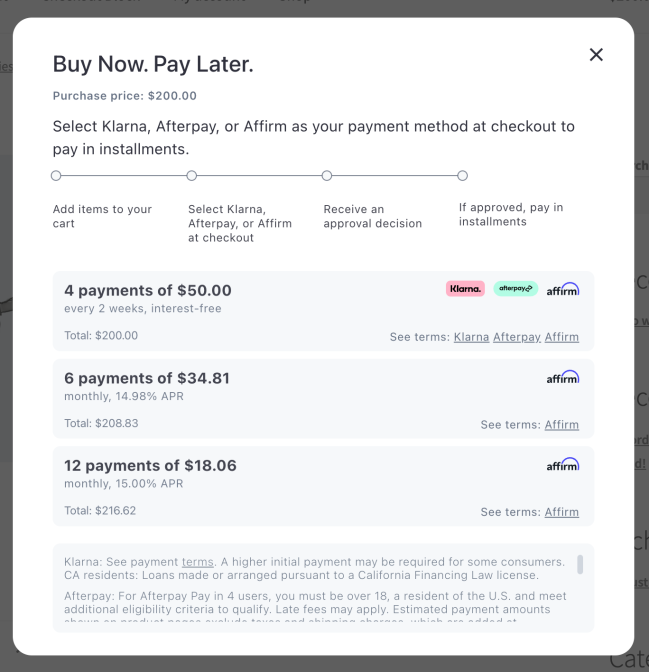

↑ Back to topCustomers will not see an increase in the product price. However, they may have an option to purchase products using a loan that accrues interest:

These loans are issued by the BNPL provider. As a result, these interest payments are collected by the BNPL provider and not by you or WooPayments.

What are the fees for BNPL methods?

↑ Back to topPlease see our full fees page for a list of the fees associated with each BNPL provider.

Supported providers

↑ Back to topWooPayments supports Affirm, Afterpay, and Klarna so that merchants in a wide range of countries can offer flexible ways for their customers to pay.

NOTE: Afterpay is known as “Clearpay” in United Kingdom, but this page and our other documentation pages will just use the name Afterpay for brevity.

Which BNPL provider(s) you can use depends on the country you chose during the WooPayments signup process.

| Account Country | Affirm | Afterpay | Klarna |

|---|---|---|---|

| Australia | ❌ | ✅ | ❌ |

| Austria | ❌ | ❌ | ✅ |

| Belgium | ❌ | ❌ | ✅ |

| Canada | ✅ | ✅ | ❌ |

| Denmark | ❌ | ❌ | ✅ |

| Finland | ❌ | ❌ | ✅ |

| Germany | ❌ | ❌ | ✅ |

| Ireland | ❌ | ❌ | ✅ |

| Italy | ❌ | ❌ | ✅ |

| Netherlands | ❌ | ❌ | ✅ |

| New Zealand | ❌ | ✅ | ❌ |

| Norway | ❌ | ❌ | ✅ |

| Spain | ❌ | ❌ | ✅ |

| Sweden | ❌ | ❌ | ✅ |

| United Kingdom | ❌ | ✅ | ✅ |

| United States | ✅ | ✅ | ✅ |

| All other supported countries not specified above | ❌ | ❌ | ❌ |

Enabling

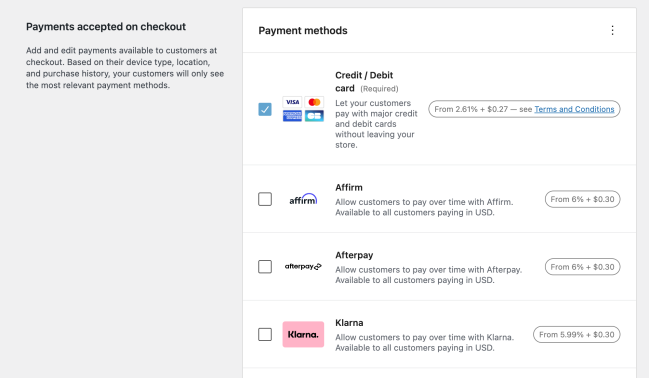

↑ Back to topTo use a BNPL method, first navigate to Payments > Settings. From there, you’ll be able to select Affirm, Afterpay, and/or Klarna in the list of additional methods.

Check the boxes for the providers you wish to enable, then click Continue. After the methods are enabled, click Go to payments settings to go back to the Payments > Settings page.

“More information needed”

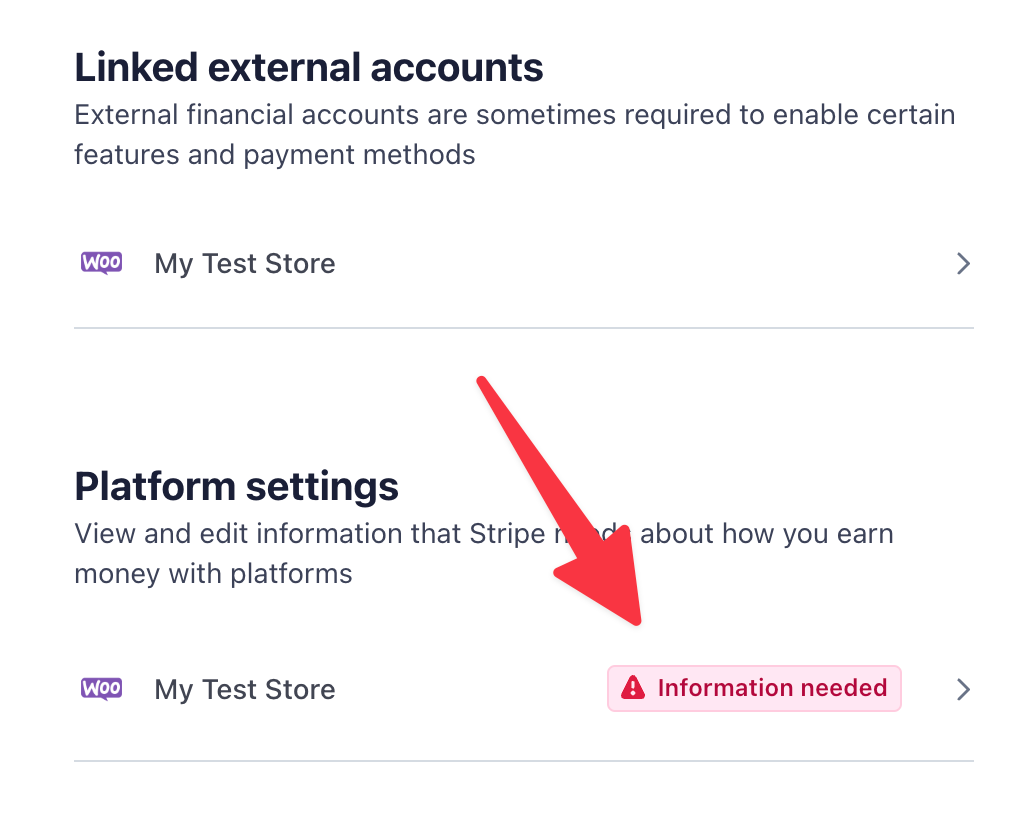

↑ Back to topIf you’re trying to enable a BNPL method, you may see a popup modal that indicates that more information is needed:

Or, you may see some information next to the payment method details in Payments > Settings:

In these cases,it means that you need to provide a few more bits of information before you can enable that particular BNPL payment method.

To do that, log into your Stripe dashboard and see if any information is missing there. If it is, you’ll see an alert in the Stripe dashboard like this:

Click the Information needed button and provide whatever missing information is required.

Be sure to save after you’re done. Once Stripe has verified the information you provided, the BNPL method should automatically be enabled.

Customer experience

↑ Back to topAfter you enable Affirm, Afterpay, and/or Klarna, customers will be available to customers on the checkout page so long as:

- They are paying in a qualifying currency.

- The value of their cart is within the minimum and maximum values for that BNPL payment method.

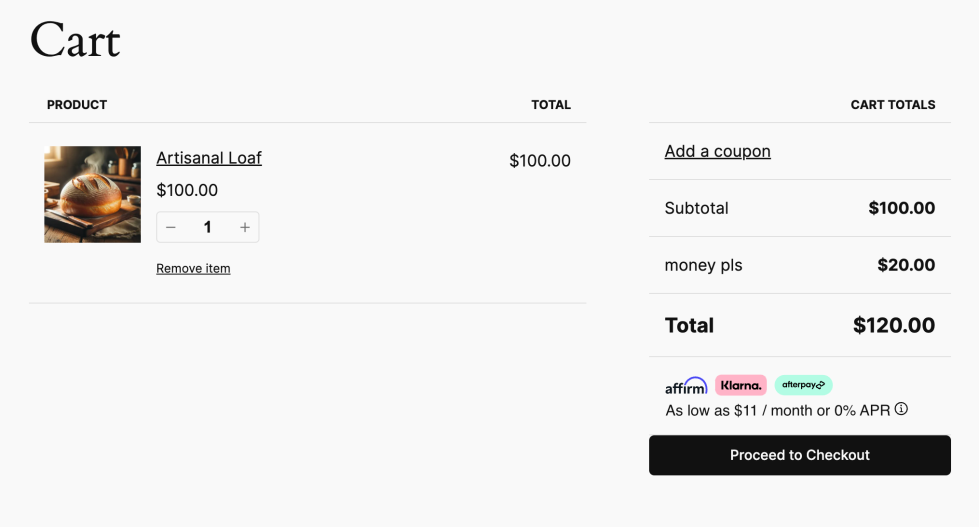

A small promotion for Affirm, Afterpay, and/or Klarna will also be shown on eligible product pages. This messaging will also show on the cart page for eligible carts.

By clicking on this promotional text, customers can see a list of potential payment plans they can use during checkout. These options depend on their location, their currency, and the product price.

Checking out

↑ Back to topDuring checkout, if the customer chooses to pay with a BNPL provider, they will be taken to that provider’s website after clicking the Place Order button. There, the customer can create or log into an account with that BNPL provider.

Next, they can accept or decline the terms of the payment plan(s) offered to them. Assuming they accept the terms, they will be returned to your site with the checkout process complete.

Affirm has a video demo and some screenshots of what their customer experience looks like. Afterpay’s documentation and Klarna’s documentation are a bit less detailed, but the customer experience is more or less the same: they log in or create an account, choose a payment plan, and finish checking out.

NOTE: BNPL providers will offer various payment plans to your customers depending on the purchase amount, the customer’s location, and other factors.

Since the BNPL provider will pay you in full as soon as the order is placed, the details of the customer’s payment plan do not impact you.

Merchant experience

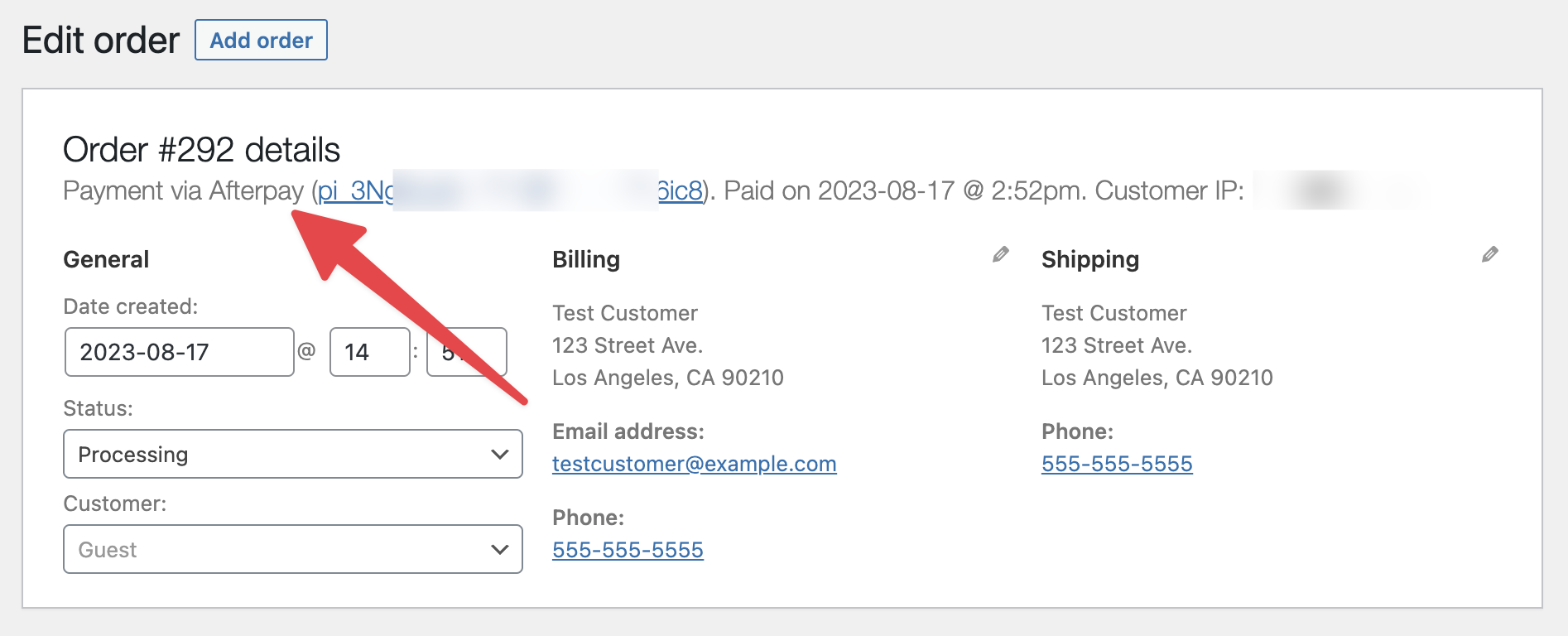

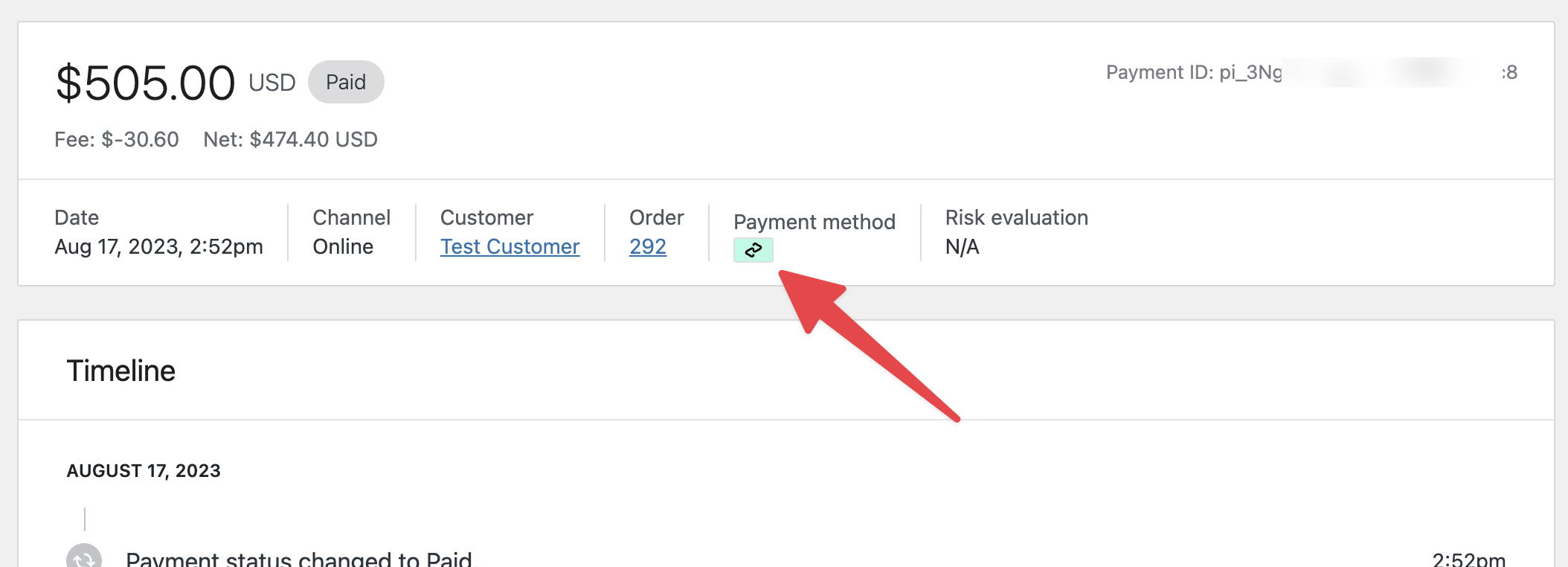

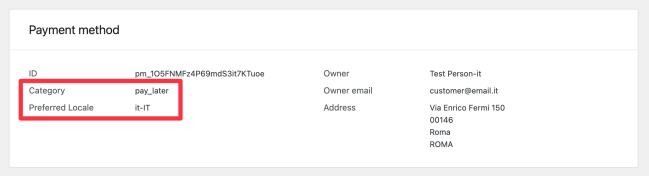

↑ Back to topOrders placed via a BNPL payment method will appear under WooCommerce > Orders and Payments > Transactions, just like orders placed with cards.

Orders paid via Klarna will have additional information on Payments > Transactions page. This information includes:

- Category, which shares which Klarna payment method the customer chose.

- Preferred Locale, which provides International Components for Unicode (ICU) locale information about the customer’s country and language.

When the transaction is complete, your WooPayments account receive the entire purchase amount immediately. The important thing to keep in mind is that the customers are not paying you over time, they are paying the BNPL provider over time.

Customer currency and BNPL

↑ Back to topOur BNPL providers do not support cross-border transactions. As such, not all of your customers will be able to pay via BNPL. Specifically, customers must be paying in the local currency of your WooPayments account country in order for them to be able to use BNPL methods.

| Your account country | To use BNPL, customers must be paying in… |

|---|---|

| Australia | AUD |

| Austria | EUR |

| Belgium | EUR |

| Canada | CAD |

| Denmark | DKK |

| Finland | EUR |

| Germany | EUR |

| Ireland | EUR |

| Italy | EUR |

| Netherlands | EUR |

| New Zealand | NZD |

| Norway | NOK |

| Spain | EUR |

| Sweden | SEK |

| United Kingdom | GBP |

| United States | USD |

Purchase minimums and maximums

↑ Back to topThere are minimum and maximum amounts that each BNPL provider can be used for, which can also vary by currency. These limits are shown in the charts below.

Affirm

↑ Back to top| Customer Country | Minimum Amount | Maximum Amount |

|---|---|---|

| Canada | $50 CAD | $30,000 CAD |

| United States | $50 USD | $30,000 USD |

Afterpay

↑ Back to top| Customer Country | Minimum Amount | Maximum Amount |

|---|---|---|

| Australia | $1 AUD | $2,000 AUD |

| Canada | $1 CAD | $2,000 CAD |

| New Zealand | $1 NZD | $2,000 NZD |

| United Kingdom | £1 GBP | £1,200 GBP |

| United States | $1 USD | $4,000 USD |

Klarna

↑ Back to topNOTE: The Klarna payment method allows customers to either buy now, pay later (BNPL), or pay immediately (Pay Now). Which of these options is offered to customers depends on the customer’s country and the amount of their purchase.

For transparency, the maximum amounts for each of these two options are documented below for each available country.

| Customer Country | Minimum Amount | Maximum BNPL Amount | Maximum Pay Now Amount |

|---|---|---|---|

| Austria | €0.10 EUR | €5,000 EUR | €10,000 EUR |

| Belgium | €1 EUR | €1,500 EUR | €10,000 EUR |

| Denmark | 1 kr DKK | 50,000 kr. DKK | 100,000 kr. DKK |

| Finland | €1 EUR | €5,000 EUR | €10,000 EUR |

| Germany | €0.10 EUR | €10,000 EUR | €10,000 EUR |

| Ireland | No minimum | €1,000 EUR | €4,000 EUR |

| Italy | No minimum | €1,500 EUR | €10,000 EUR |

| Netherlands | €1 EUR | €5,000 EUR | €15,000 EUR |

| Norway | No minimum | 75,000 kr NOK | 100,000 kr NOK |

| Spain | No minimum | €4,000 EUR | €10,000 EUR |

| Sweden | No minimum | 100,000 kr SEK | 150,000 kr SEK |

| United Kingdom | No minimum | £2,000 GBP | £4,000 GBP |

| United States | No minimum | $10,000 USD | $4,000 USD |

Testing BNPL purchases

↑ Back to topBNPL payment methods can be tested while in test mode, just like any other payment method.

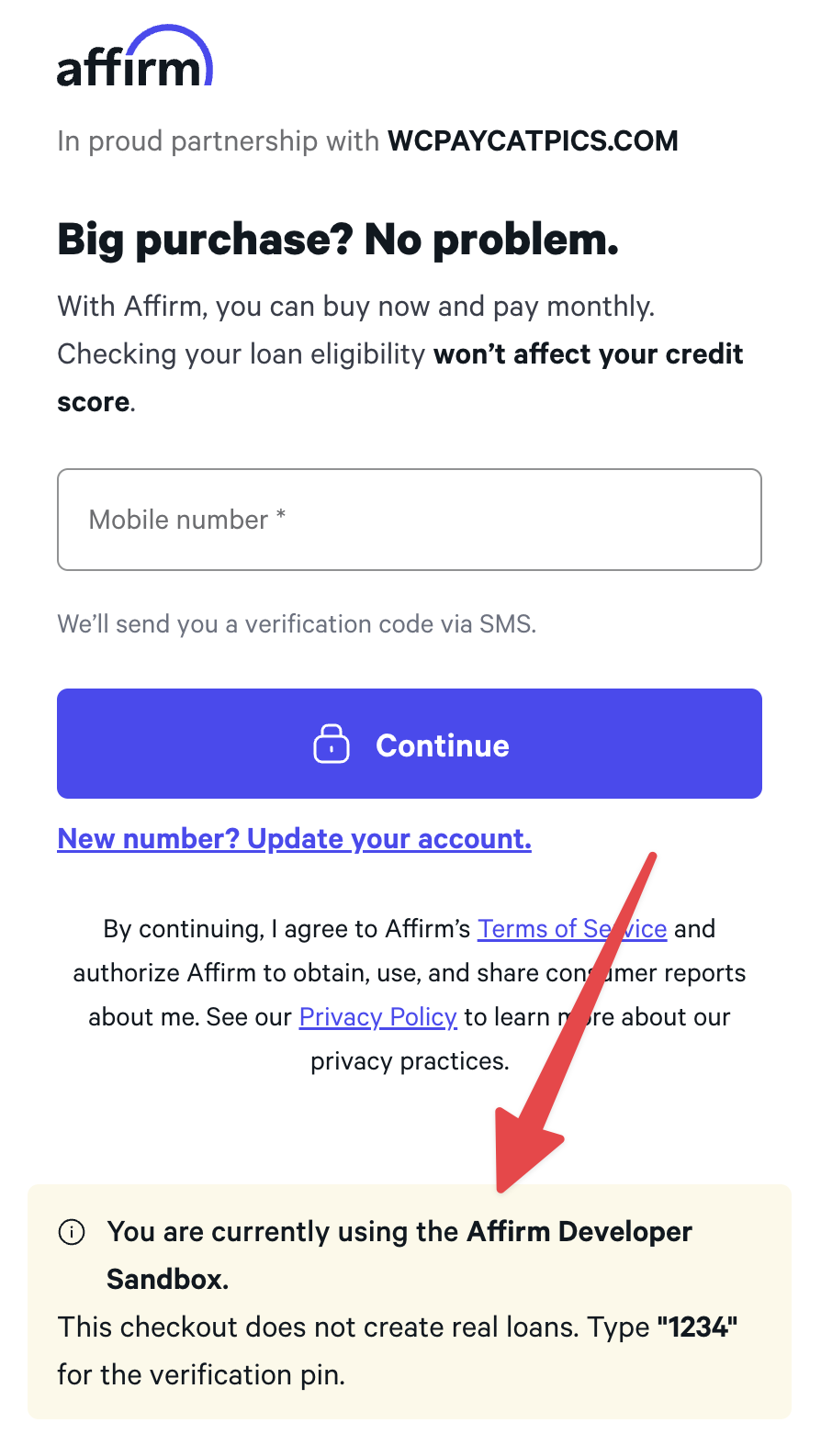

Affirm

↑ Back to topIf you’re testing Affirm, you’ll be shown the following screen after placing your test order:

Enter your mobile phone number, click Continue, and then enter 1234 as the verification code. Next, enter a fake name and email address, click Continue, and then enter a fake birth date and Social Security Number.

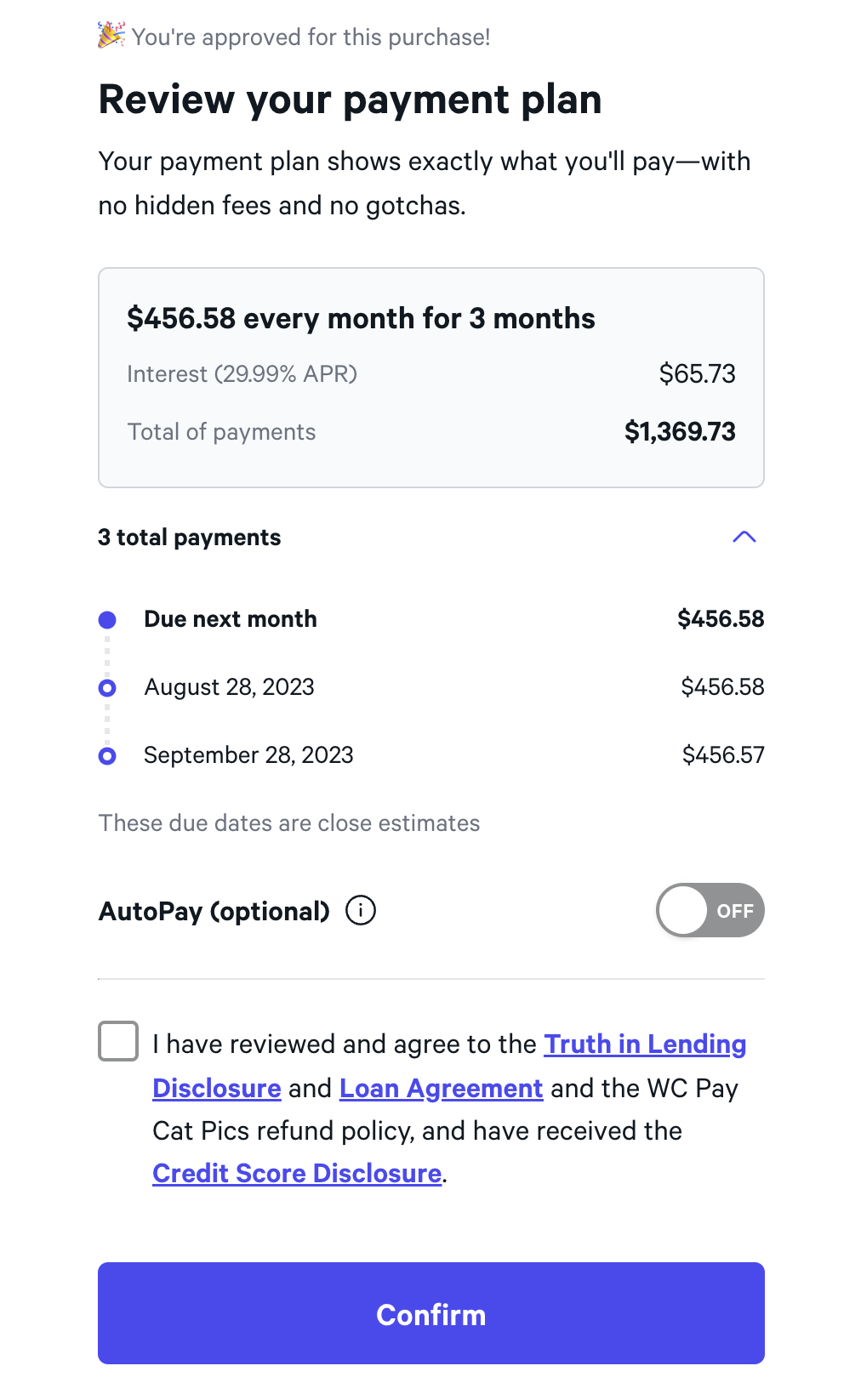

Choose from one of the available payment plans and click Continue.

Finally, disable the AutoPay option on the summary page, check the terms and conditions checkbox, then click Confirm.

After confirming, you’ll be taken back to your site’s Order Received page as normal.

Afterpay

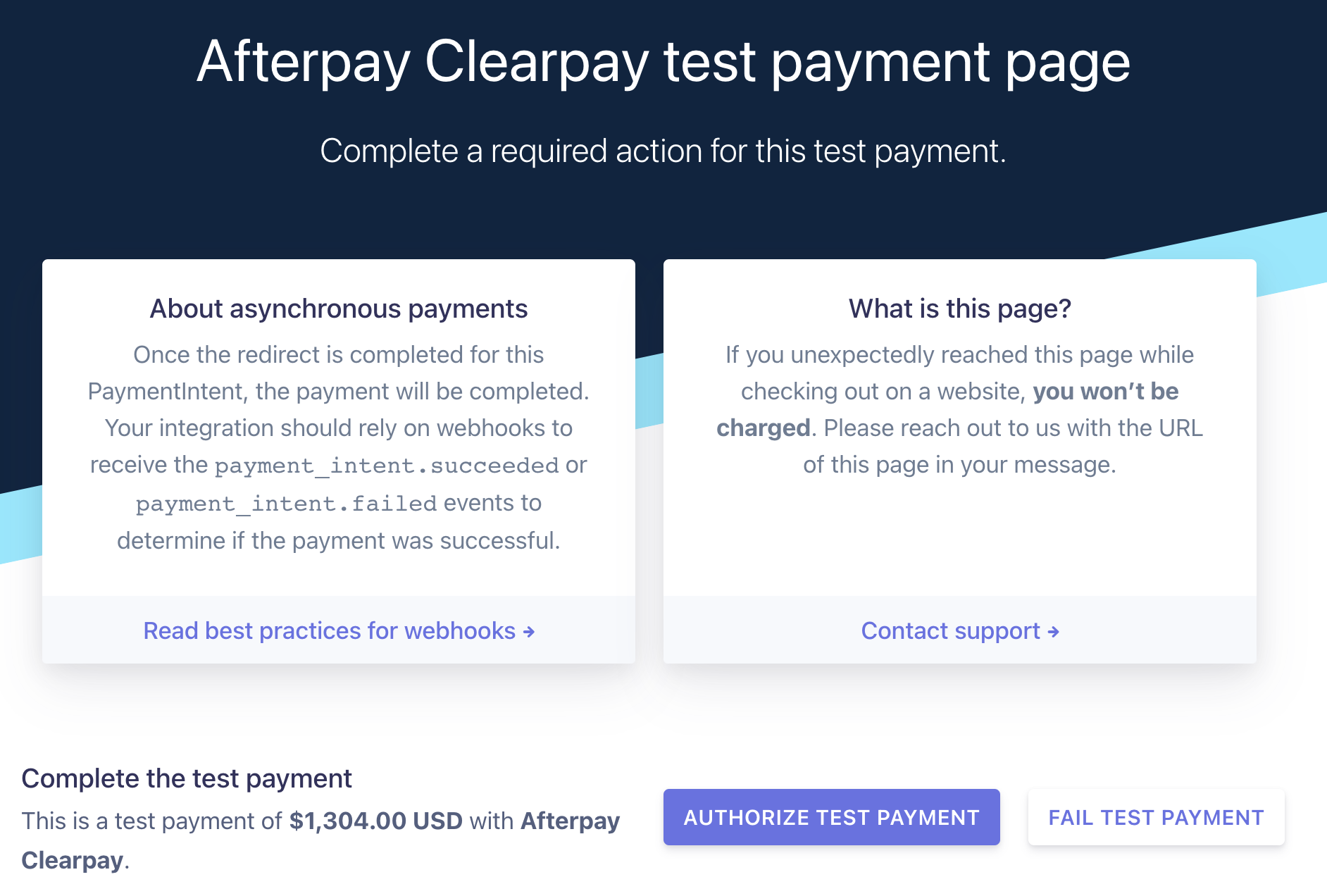

↑ Back to topIf you’re testing Afterpay, you’ll be shown the following screen after placing your test order:

Click Authorize Test Payment to test a successful order or Fail Test Payment to test a failed order. If you authorize the test, you’ll be taken back to your site’s Order Received page.

Klarna

↑ Back to topIf you’re testing Klarna, you will go through a mockup of the Klarna account creation flow alongside placing an order.

Klarna test information

Depending on the country you selected when creating your WooPayments account, customers will be asked to provide different personal details. Klarna has test information that you can use to achieve specific results.

The country-specific information to place a successful test purchase via Klarna can be found below, along with a link to additional information if you’d like to test other experiences, such as declines or disputes.

Payment methods

Regardless of what country the WooPayments account is based in, you may be prompted to provide a payment method such as a debit card. You can find the test card information for Klarna below.

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Debit card number | 4012 8888 8888 1881 |

| Expiration date | Any future date in a MM/YY format. |

| CVV | 123 |

It is also possible for you to test other payment methods via Klarna. You can read more about these payment methods at this link.

Austria

| Email address | customer@email.at |

| Phone number | +4306762600456 |

| First name | Test |

| Last name | Person-at |

| Address | Mariahilfer Straße 47 |

| Postcode / Zip code | 1060 |

| City | Wien |

| Country | AT |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in Austria at this link.

Belgium

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.be |

| Phone number | +4306762600456 |

| First name | Test |

| Last name | Person-be |

| Address | Grote Markt 1 |

| Postcode / Zip code | 1000 |

| City | Brussel |

| Country | BE |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in Belgium at this link.

Denmark

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.dk |

| Phone number | +4533137112 |

| First name | Test |

| Last name | Person-dk |

| Address | Nygårdsvej 65 |

| Postcode / Zip code | 2100 |

| City | København Ø |

| Country | DK |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in Denmark at this link.

Finland

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.fi |

| Phone number | +3580401234567 |

| First name | Person FI |

| Last name | Test |

| Address | Mannerheimintie 34 |

| Postcode / Zip code | 00100 |

| City | Helsinki |

| Country | FI |

| Date of birth (DD-MM-YYYY) | 01-01-1999 |

You can find some other ways to test Klarna payments in Finland at this link.

Germany

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.de |

| Phone number | +4901761428434 |

| First name | Mock |

| Last name | Mock |

| Address | Neue Schönhauser Str. 2 |

| Postcode / Zip code | 10178 |

| City | Berlin |

| State / County | Berlin |

| Country | DE |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in Germany at this link.

Ireland

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.ie |

| Phone number | +3536789010 |

| First name | Test |

| Last name | Person-ie |

| Address | 30 King Street South |

| Postcode / Zip code / Eircode | D02 C838 |

| City | Dublin |

| Country | IE |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in Ireland at this link.

Italy

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.it |

| Phone number | +393339741231 |

| First name | Test |

| Last name | Person-it |

| Address | Via Enrico Fermi 150 |

| Postcode / Zip code | 00146 |

| City | Roma |

| Province | Roma |

| Country | IT |

| Fiscal code (Codice fiscale) | RSS BNC 80A41 H501B |

| Date of birth (DD-MM-YYYY) | 10-07-1980 |

| ID Card | Use this image when prompted. |

You can find some other ways to test Klarna payments in Italy at this link.

Netherlands

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.nl |

| Phone number | +31689124321 |

| First name | Test |

| Last name | Person-nl |

| Address | Osdorpplein 137 |

| Postcode / Zip code | 1068 SR |

| City | Amsterdam |

| Country | NL |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in the Netherlands at this link.

Norway

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.no |

| Phone number | +4306762600456 |

| First name | Jane |

| Last name | Test |

| Personal number | NO1087000571 |

| Address | Edvard Munchs Plass 1 |

| Postcode / Zip code | 0194 |

| City | Oslo |

| Country | NO |

| Date of birth (DD-MM-YYYY) | 01-08-1970 |

You can find some other ways to test Klarna payments in Norway at this link.

Spain

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.es |

| Phone number | +34910695129 |

| First name | Test |

| Last name | Person-es |

| Address | C. de Atocha, 27 |

| Postcode / Zip code | 28012 |

| City | Madrid |

| Province | Madrid |

| Country | ES |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

| ID card | Use this image when prompted. |

You can find some other ways to test Klarna payments in Spain at this link.

Sweden

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.se |

| Phone number | +46701740615 |

| Personal number | SE194103219202 |

| First name | Alice |

| Last name | Test |

| Address | Södra Blasieholmshamnen 2 |

| Postcode / Zip code | 11 148 |

| City | Stockholm |

| Country | SE |

| Date of birth (DD-MM-YYYY) | 21-03-1941 |

You can find some other ways to test Klarna payments in Sweden at this link.

United Kingdom

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.uk |

| Phone number | +4408082580300 |

| First name | Test |

| Last name | Person-uk |

| Address 1 | 10 New Burlington Street |

| Address 2 | Apt. 214 |

| Postcode / Zip code | W1S 3BE |

| City | London |

| County | London |

| Country | AT |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in the United Kingdom at this link.

United States

| FIELD | VALUE FOR A SUCCESSFUL TEST PAYMENT |

|---|---|

| Email address | customer@email.us |

| Phone number | +13106683312 |

| First name | Test |

| Last name | Person-us |

| Last four digits of SSN | 1234 |

| Address | 509 Amsterdam Ave |

| Postcode / Zip code | 10024-3941 |

| City | New York |

| State | NY |

| Date of birth (DD-MM-YYYY) | 10-07-1970 |

You can find some other ways to test Klarna payments in the United States at this link.

Klarna test payment flow

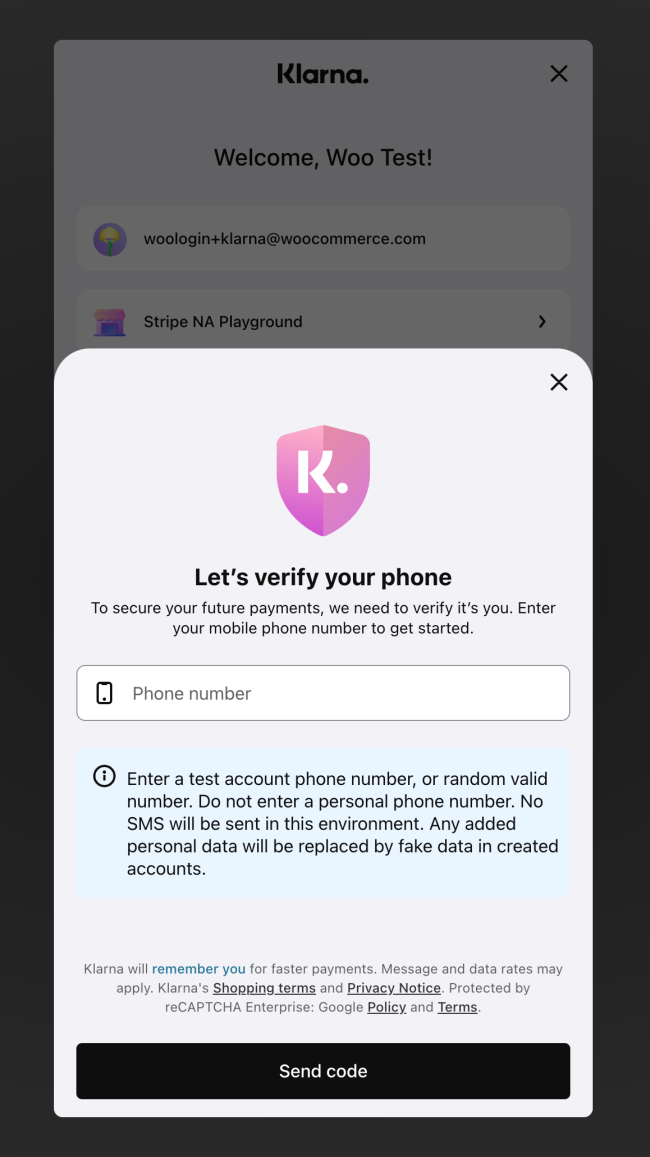

After placing a test order via Klarna, you’ll be shown the following screen:

This field will be pre-populated with the phone number used at checkout (if applicable). Enter the test phone number based on your WooPayments account country, click Send code, and then enter any six digit string except for 999999 as the verification code.

Next, enter the email address, address, and other information based on your WooPayments account country.

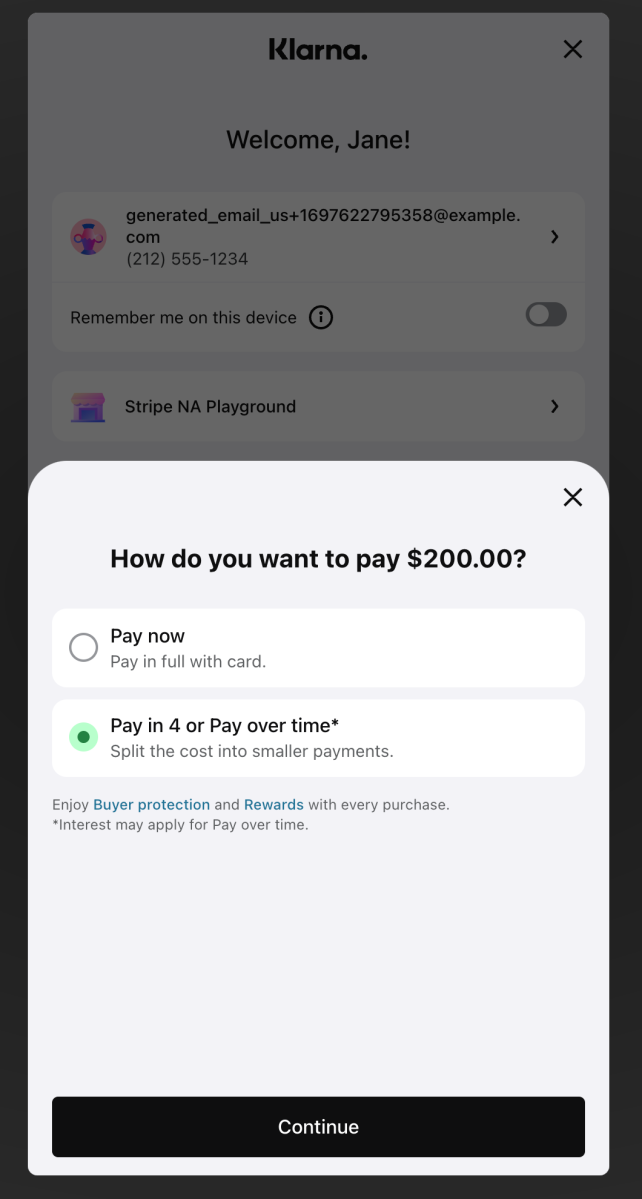

Choose from one of the available payment methods and click Continue.

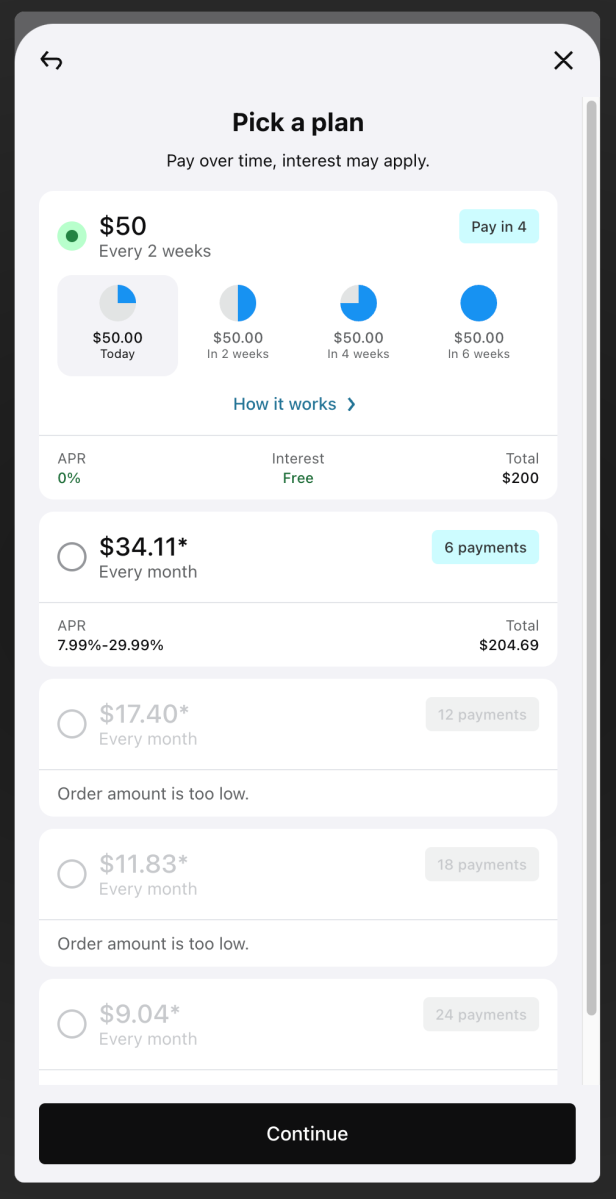

Select any option aside from Pay now and select Continue. Choose from one of the available payment plans and click Continue.

Review the order information and select Pay [amount] today with Klarna to complete the order. Next, you’ll be taken back to your site’s Order Received page as normal.

Refunds

↑ Back to topYou can fully or partially refund BNPL transactions just as you would any other transaction. Each BNPL provider has their own time periods in which the refund must be issued:

- Affirm: 120 days after the order was placed.

- Afterpay: 180 days after the order was placed.

- Klarna: 180 days after the order was placed.

As with other payment methods offered via WooPayments, the transaction fees are not refunded to you.

Disputes

↑ Back to topBecause customers must authenticate with their BNPL provider of choice during the purchase process, this helps reduce the risk of unauthorized payments. However, customers can still dispute BNPL transactions for other reasons.

Notably, the timelines for BNPL disputes can differ from those of regular card payment disputes, so we have outlined the relevant details below.

Customers must dispute the transaction within:

- Affirm: 60 days

- Afterpay: 120 days

- Klarna: 60–180 days1

1The dispute window for the Transaction unauthorized dispute reason is 60 days. Other dispute reasons are 180 days.

Once a dispute has been created, you must submit evidence within:

- Affirm: 15 days

- Afterpay: 14 days

- Klarna: 7 days

After you submit evidence, the BNPL provider will make a decision within:

- Affirm: 15 days

- Afterpay: 30 days

- Klarna: 90 days

Aside from the timeline changes above, disputes for BNPL orders function the same as any other dispute (e.g., you can view them and submit evidence under Payments > Disputes).

Prohibited products and businesses

↑ Back to topBecause BNPL payment methods inherently involve a third-party company, there are additional restrictions on the types of products you can sell with them. In addition to our general list of prohibited or restricted products, the restrictions below also apply.

Affirm

↑ Back to top- Home improvement services, including contractors

- Titled goods and auto loans, including cars, boats, and other motor vehicles

- Professional services, including legal, consulting, and accounting

- Non-fungible tokens (NFTs)

- Business-to-business (B2B)

- Subscription products

Please see the full list for more details.

Afterpay

↑ Back to top- Alcohol

- Donations

- Pre-orders

- Non-fungible tokens (NFTs)

- Business-to-business (B2B)

- Subscription products

Please see the full list for more details.

Klarna

↑ Back to top- Charities

- Political initiatives, organizations, or parties

- Subscription products

How do I switch from a BNPL extension?

↑ Back to topIf you already use a BNPL extension from our marketplace (e.g., Affirm, Afterpay, or Klarna Payments), you should disable that extension prior to activating the matching BNPL payment method in WooPayments.