Buy now, pay later can boost your conversions

Give customers additional buying power with buy now, pay later (BNPL) and open the door to new audiences and bigger orders. And with WooPayments you can manage it all from one dashboard.

The growing preference for BNPL

Offer the checkout customers want

Buy now, pay later is transforming the way people pay — and how much they buy. 70% of users say they spend more while leveraging BNPL than they would otherwise (Source: Lending Tree).

Get paid up front, risk-free

You’re paid in full, while customers pay over time. BNPL providers take on buyer fraud and repayment risk, protecting you from unauthorized payment disputes and giving you more time to spend on your business.

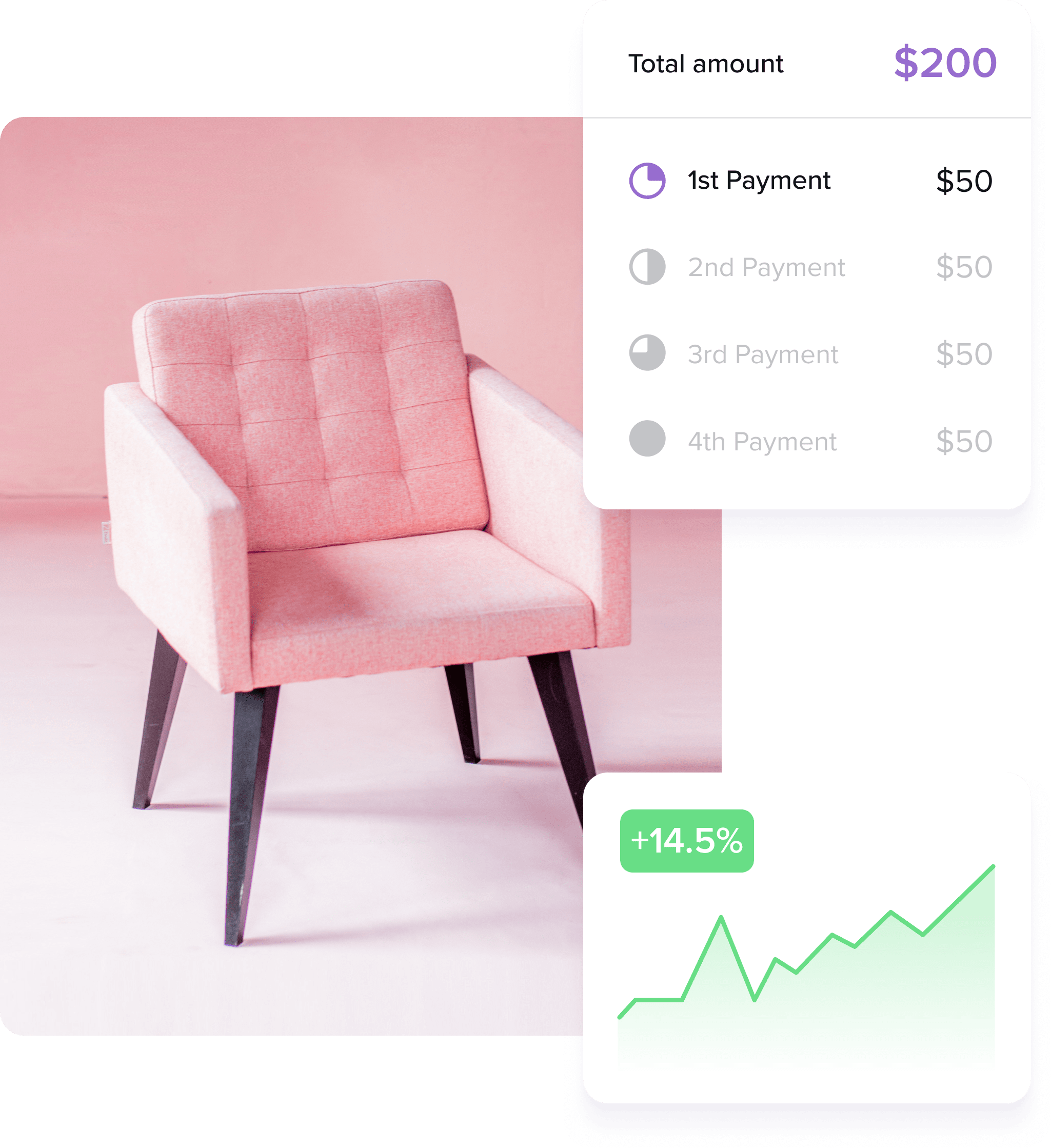

Increase average order value

Take the price tag out of the equation. Convenient smaller payments enable customers to spend more, raising average order value as much as 14.5% (Source: Stripe).

Give buyers more options to convert

Give customers the confidence to buy that big-ticket item — today. Make checkout more appealing and motivate customers to complete their purchase when they see the cost split into simple, clear payments.

Find new customers

Access a rapidly growing network of millions of buyers. The flexibility of buy now, pay later is especially popular with younger customers and can help make large purchases more accessible.

Activate BNPL instantly on WooPayments

The world’s favorite buy now, pay later options are right at your fingertips with WooPayments — all from one dashboard, without needing multiple extensions and logins. Enable BNPL on your store in moments and save time with a streamlined approval process.

Klarna

Turbocharge your business. Klarna is the first choice for over 550 million retailers across the globe.

Tap into Klarna’s 150 million shoppers worldwide who enjoy the flexibility to pay now, later, or over time.

Klarna is available in the US, UK, Austria, Germany, Netherlands, Belgium, Spain, Italy, Ireland, Denmark, Finland, Norway, Sweden, and more to come!

Affirm

Trusted by 240k+ businesses worldwide, Affirm retailers see an average order value lift of 63%.

With a network of 16m+ active users, Affirm offers payment options with a wide range of term length options. Allow your customers to choose from 4 interest-free payments every two weeks and longer installments up to 36 months – for purchases up to $30,000 (Source: Affirm Q3 2023 Earnings Report).

Available to businesses in the United States and Canada.

Afterpay

Afterpay retailers see up to an average 58% increase in average order value and a 2X increase in items per order¹.

Connect with 20 million² global users — 72%³ of which are Gen Z or Millennials — and let customers pay in four⁴ bi-weekly installments or pay monthly⁵.

Available to businesses in the United States, Canada, Australia, New Zealand, and the United Kingdom.

- Afterpay – Mastercard Incrementality Analysis, June, 2022

- Block Inc. Q2, 2022 Earnings Call

- Afterpay Internal Demographics, Q1, 2023

- You must be 18 or older, a resident of the U.S. and meet additional eligibility criteria to qualify. Late fees may apply. Click here for complete terms. Loans to California residents made or arranged pursuant to a California Finance Lenders Law license.

- US only.